Around five years ago, some predicted the demise of city centres and office spaces, convinced that remote work would become the norm and urban life would lose its appeal. To them, the pandemic presaged a shift in preferences, with many escaping the city to seek a slower, less crowded lifestyle, trading city skylines for open countryside.

Between 2019 and 2021, London’s population shrank by 76,000 – the first decline in years. Across the Atlantic, America’s largest cities, including New York, Los Angeles, and Chicago, saw an average drop of 182,000 residents between 2020 and 2022.

But the escape was short-lived. While many focused on what cities couldn’t offer, they overlooked what makes them indispensable. Cities bring people together, nurture collaboration, and serve as grounds for innovation and productivity.

Even within urban areas, the most desirable places to work aren’t on the outskirts – they’re often in vibrant, dynamic centres where ideas, talent, and opportunity converge.

This reality is reflected in the commercial property market. Demand for city centre offices is rebounding, particularly in well-connected locations.

London’s economy relies on a vast commuter network, from Transport for London services within the city to National Rail links extending beyond it. As a result, office spaces continue to cluster around major transport hubs, aligning with commuters’ preference for efficient, affordable journeys.

Like the denizens of other cities, Londoners have highlighted the cost of commuting as a key hindrance to working in the office. Analysis by the Centre for Cities found that 42% of employees in London cited the reduced cost of commuting as a major benefit of remote work, while only 17% cited disliking the office itself.

Businesses seeking in-office attendance would do well to recognise the growing sensitivity to the time and money required for a daily commute. One way they are doing so is by selecting sites with excellent access to public transportation networks.

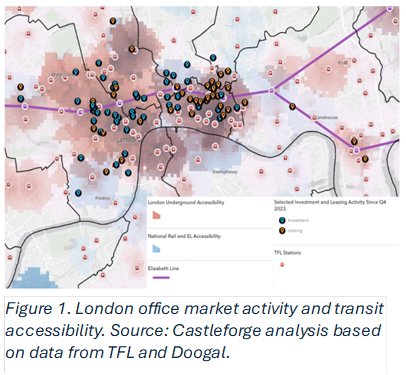

These trends can be observed by overlaying recent office deals with Transport for London’s Public Transport Accessibility Level (PTAL) scores. PTAL scores rate locations based on their accessibility to public transport services, considering factors including distance to the nearest public transport stop and the frequency of services at those stops.

On the map, areas with good access to the Tube are shaded in red, while areas with good access to National Rail (including the Elizabeth Line) are shaded in blue. The darkest shaded areas represent the best access to commuter services, where these layers converge.

By pinning major office transactions from the past year onto the map, we see a correlation between easily accessible areas and office market activity.

Data from CoStar, released last year, revealed a similar connection. Locations within a short walk from major train stations, such as Euston and Liverpool Street, outperformed the rest of the Central London office market, with soaring rents. The rest of Central London, meanwhile, has seen low rental growth and vacancy rates 200 basis points higher than well-connected areas.

Both employees and employers benefit from a well-connected office. Having an office near a transit stop saves employees time and money and widens the available pool of potential talent for employers. For example, TFL data shows that roughly one million people live within 30 minutes of Liverpool Street Station, around 250,000 more than those living within 30 minutes of Paddington.

What was unclear at the onset of the pandemic is clear now: investing in the durable economic vibrancy of our cities is a good bet. Centrally located offices are officially back in the mainstream.

As more employees return to in-person work in the capital, investors in office spaces and occupiers alike have an opportune moment to invest in attractive locations that are set to benefit from strong supply and demand drivers well into the future.

Mathew Chemplayil is research associate at Castleforge