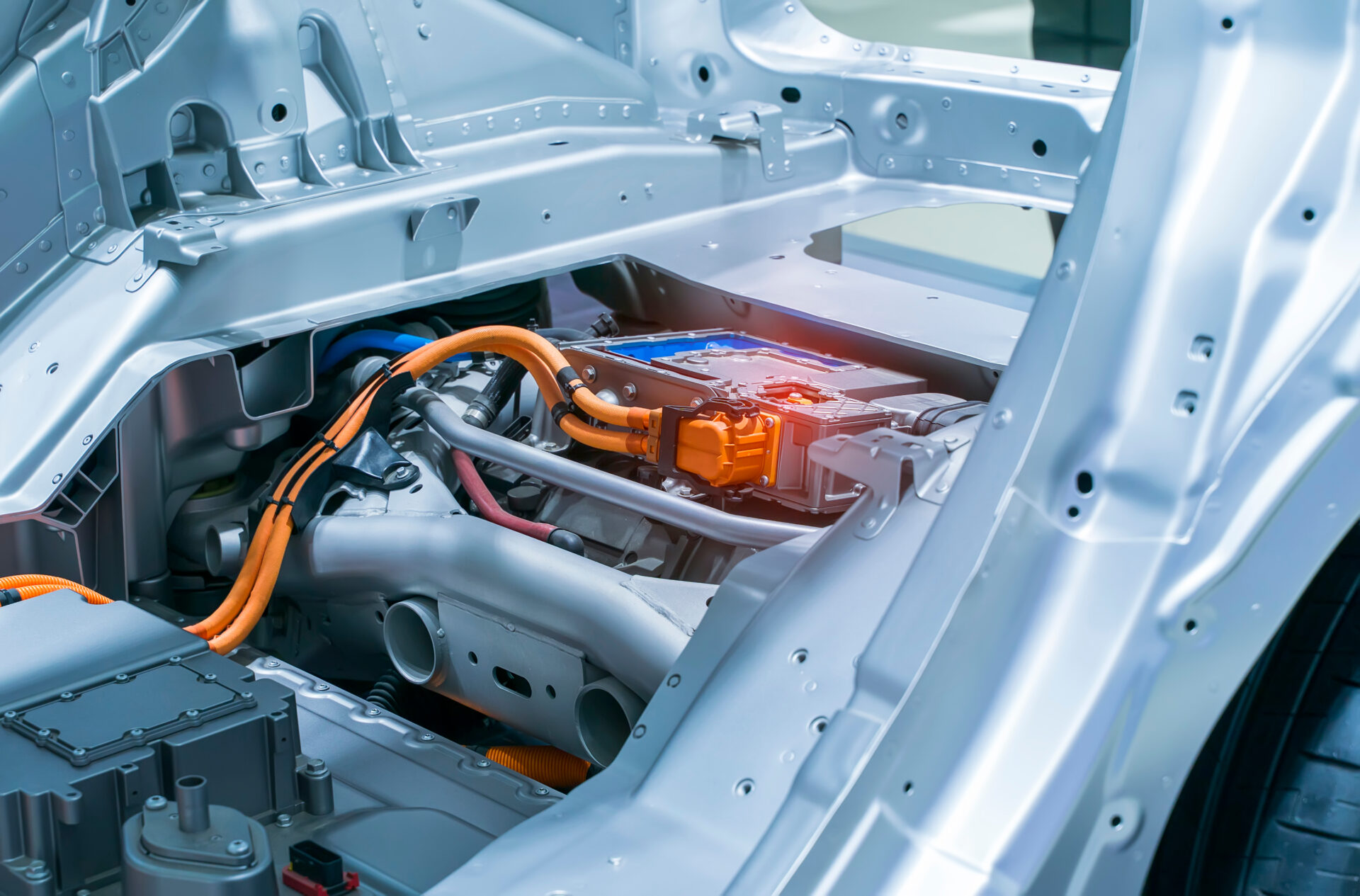

Global EV sales growth is set to drive demand for automotive and battery sector workers, especially in areas related to EV manufacturing, servicing and charging infrastructure.

The global electric vehicle (EV) sales market has grown by 28% so far in 2025, with 7.2 million units sold worldwide between January and May, according to new figures from Rho Motion.

In May alone, 1.6 million EVs were sold, marking a 24% increase on the same month last year and an 8% rise from April 2025.

While China continued to lead in volume, selling more than one million EVs in a single month, Europe showed strong growth, supported by national incentives that are expected to have a significant impact on EV sector employment, skills demand and fleet investment.

Charles Lester, data manager at Rho Motion, said: “The story this month with global vehicle sales is the continued chasm between Chinese market growth… versus the faltering market in North America.

“The European region is showing healthy signs of electrification, especially in Spain and Italy. At this stage in the EV adoption curve, incentives and policies are having a major impact.”

Europe recorded 1.6 million EV sales from January to May 2025 – a 27% increase year-on-year.

Key markets included Germany (+45% YTD) and the UK (+32% YTD), with previously slower adopters like Spain (+72%) and Italy (+58%) now accelerating rapidly.

Germany launched a new corporate fleet incentive programme to further boost uptake, including special depreciation rules and tax relief for electric vehicles.

According to Rho Motion, this move is expected to positively impact the market, given that company fleets account for more than half of all new vehicle purchases in the country.

In contrast, North America’s EV market grew just 3% in the same period.

Canada’s 20% drop in EV sales – linked to a pause in Government support – held back regional growth, while the US saw only a 4% increase, despite federal tax credits still in place until the end of 2025.

The approaching phase-out of these incentives in 2026 could result in short-term workforce and production pressure across US automotive plants, as manufacturers and suppliers respond to changing demand patterns.

China remained the global leader in EV volume, with 4.4 million units sold in the first five months of 2025, up 33% year-on-year.

May 2025 marked the first time this year the country exceeded one million units in a single month.

Chinese manufacturers such as BYD continue to expand internationally, with the company’s compact Dolphin Surf EV now entering the European market.

Rho Motion’s report highlighted the role of policy in shaping EV adoption and calls attention to how workforce planning will need to adapt.

With electrification accelerating across multiple regions, the global supply chain – including component manufacturing, battery systems, and vehicle servicing – is expected to see growing pressure to recruit and retrain workers.