Wales Pension Partnership (WPP) has set up a new investment company, pooling £25bn from 22 local authority pension schemes.

The partnership will manage assets for 412,000 members, making it the biggest pension fund in Welsh history.

The fund will focus on investing in local projects to support growth and jobs across Wales.

Pensions Minister Torsten Bell said: “Pensions are a massive part of the economy – and we’re seeing this brought to life here in Wales, where a successful Local Government Pension Scheme is investing in the right places to drive opportunity and growth for the local community.

“I’m delighted to visit Uskmouth Power Station in Newport, which has had a £6 million boost from the Wales Pension Partnership, creating 300 jobs which mean opportunity and prosperity at a local level.

“Making sure everyone can benefit from the potential of larger pension pools ties into the ambitions of our Plan for Change to boost investment in communities across the country, bringing long-term economic benefits.”

The partnership has recently invested £6.5m in the redevelopment of Uskmouth Power Station, helping to create 300 new full-time jobs during construction.

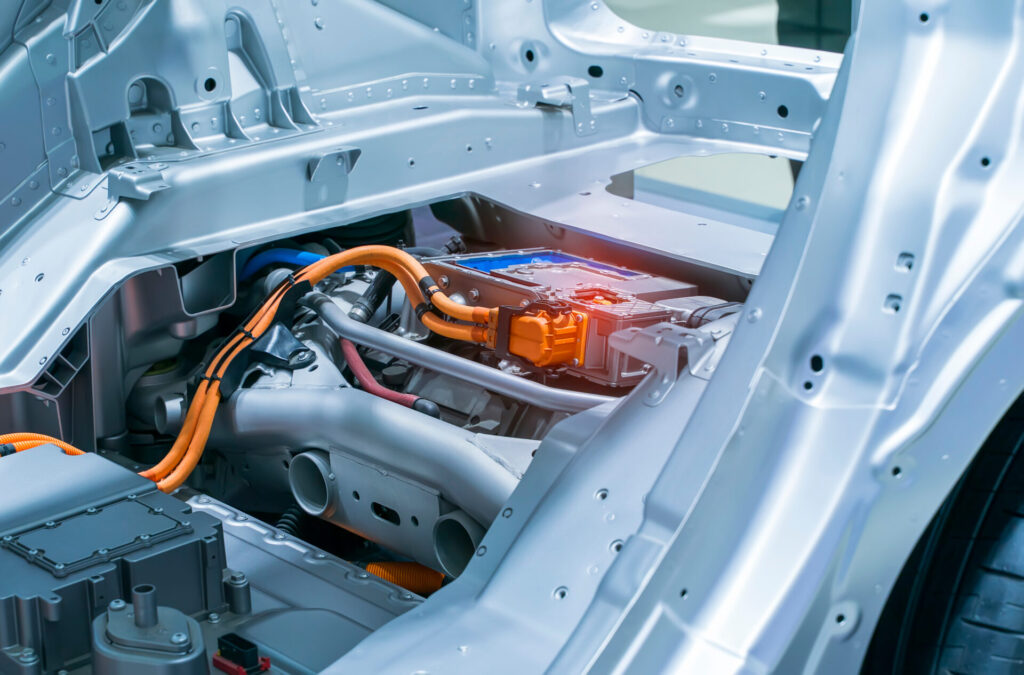

The project is turning the former coal-fired site into a sustainable energy facility.

The WPP said: “The Wales Pension Partnership investment in Uskmouth Battery Energy Storage Systems demonstrates our ambitions to attract investment into crucial Welsh infrastructure and secure national energy supplies.

“This investment shows our commitment to working with Quinbrook and our strategic partner GCM Grosvenor to: deliver strong investment returns for our pensioners, ensure long-term energy security, reduce carbon emissions, provide jobs and regeneration opportunities across Wales.

“This is one of many projects that we have in our investment pipeline and will be unveiling over the next 12 months.”

Cabinet Secretary for Economy, Energy and Planning, Rebecca Evans said: “We have long recognised the benefits of a strong single Welsh Local Government Pension Scheme pool.

“We want to see the Wales Pensions Partnership continue to go from strength to strength delivering returns for members and be able to invest in economic growth for Wales and the UK.”

Minister of State for Local Government and English Devolution, Jim McMahon said: “We are determined to get the best value out of taxpayers’ money, which is why we are reforming the Local Government Pensions Scheme pools in Wales and England to be more efficient, fit-for-purpose and deliver for public servants and their communities.

“The scheme plays a vital role in boosting investment and growth across Wales and ultimately putting more money in working people’s pockets as part of our Plan for Change.”